My photos are now available in NFT collections

NFT collections

All over the creative digital world, everyone is talking about and investing in NFT collections. So, what is all the fuss? Here are some reasons why I have also gone down that route and embraced the changes.

In late-2021, I bit the bullet and minted two digital collections of my work on Opensea across the Ethereum (ETH) network. This was not a big leap for me personally, as I’ve been interested in crypto and decentralised technologies for more than five years now. When the froth around NFTs started to be whipped up, it was easy to see why it would grow such a large following so quickly. But, having been involved in IT for many years too, I understand why there is also mass rejection in opposition to this “fad”. Most people simply don’t know anything about it at the moment, so trust their media to provide the context of what is happening in this space. I lived and worked through the nineties and remember how most people baulked at the concept of the internet in the early days. People refused to use e-commerce “add to cart” tech-based on fear and ignorance. Technology has continued to move at that speed of light, and nowadays, we all have our lives online. We seem to be at that inflection point again.

What is an NFT?

NFT stands for a non-fungible token but simply put, is it the new digital answer to collectables. Everyone has collected something in some form or another in their life. We all understand that the fewer items produced of any collectable, the more value it will have over time. Supply and demand, so nothing fundamentally new here. What if I told you that NFTs were just collectables on a new financial system?

I have written a more detailed and technical article around so many of the acronyms that are barrelling towards you – crypto token acronyms in their thousands, NFT, DeFi, DAO and Web3.0, to name a few. All components of a new landscape started many years ago in dark places where nerds and cypherpunks met to share Red Bulls and computer code.

Read my full article here if you are not sure what blockchain is and how an NFT is minted or why they are seen as digital collectables. It’s not as difficult to do as people think. You can buy a certain crypto, like Ethereum (ETH), using your cash, send it to your crypto wallet that is linked to a blockchain network, then buy some of my photos that are on that chain. You get to own the NFT, and I get crypto into my own wallet (no centralised intermediary)

That digital “trading” card, for a better phrase, will be rarer because I may only mint a single one is now an investment for you. You can keep it as a collector or wait until the crypto rises in price and then sell (trade) it on the same site you bought it for a profit. I get a percentage royalty amount every time that NFT is traded onwards, unlike prints.

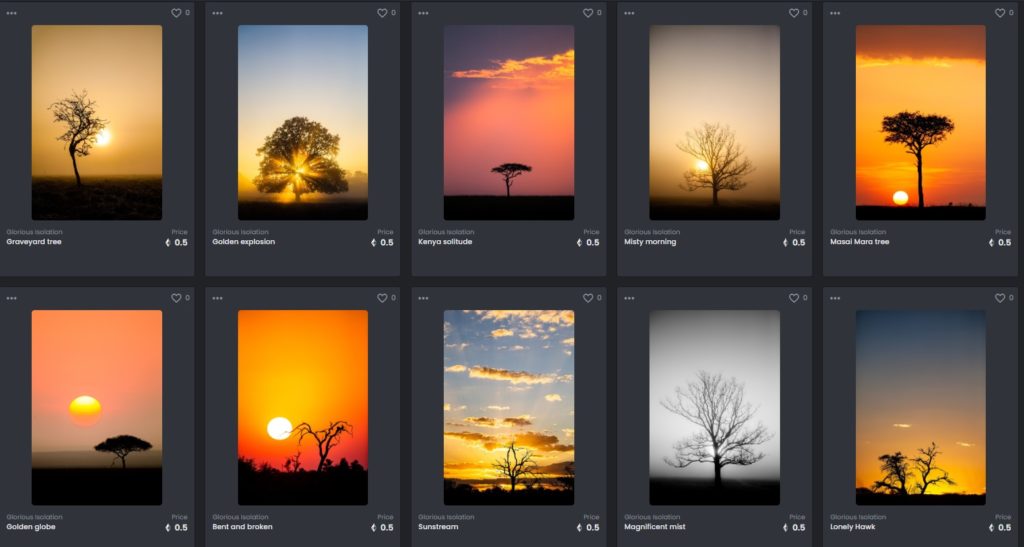

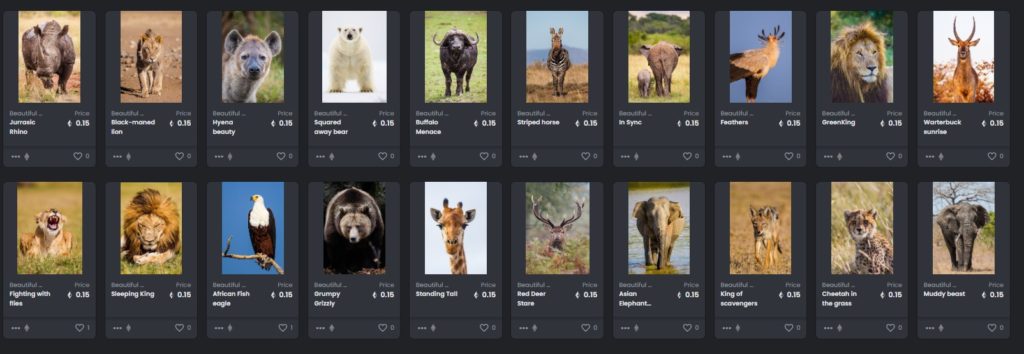

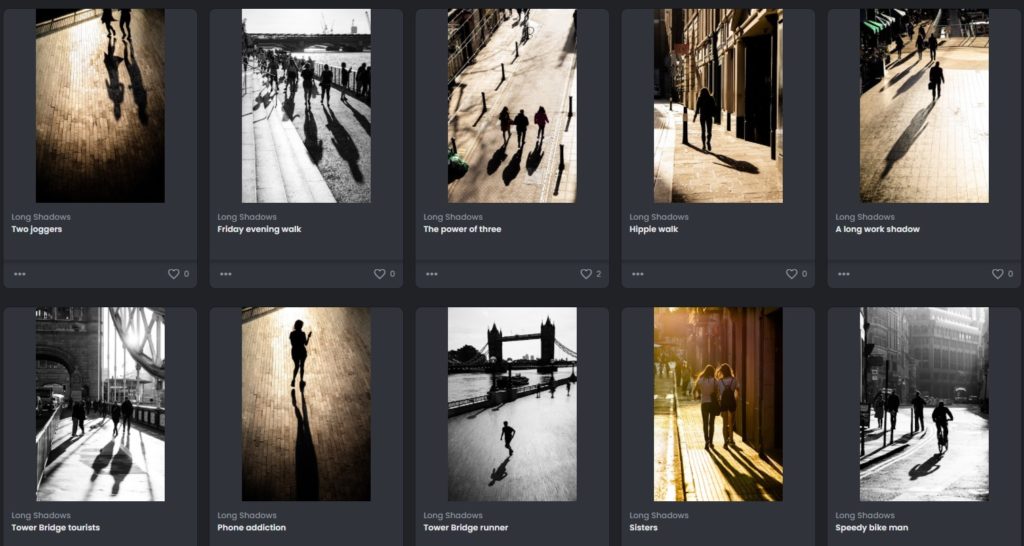

My collections

I have three collections at the time of writing, and there will be more over time. You can upload and mint any one of your photos and try to sell it as an NFT. There is no real boundary to what you can mint, but there may not be a buyer unless it’s of a good enough quality. Another analogy you can is that NFT sites are like bricks-and-mortar art galleries. You would approach galleries with a body of work (in print) and hope they featured them. These would go on sale, and hopefully, your work would go off to a new home. NFTs are the same, except for the royalty structures.

Comparing a photo to an NFT

Nothing beats holding or seeing one of your prints on a wall. Getting a pack of prints back from the lab is no different. The smell reminds me of the darkroom days of the eighties and the feeling of enjoyment when you mail them off to a client. Will this market continue with the advent of the latest tech? The short answer is yes- in the short term anyway. People will still have real homes, which will still furnish them with real things.

As I’ve said already, prints are not the same as NFTs, which are more comparable with art bought/consumed for collecting and investment. A limited-edition print will have value in the future, but you as the creator won’t see any royalties if the collector deems it a print to sell onwards to other collectors.

At the moment, I see both markets working alongside one another, but technology is moving so fast eventually, the money will flow towards NFTs. In the metaverse, there are games where you can earn tokens (currency) and buy virtual real estate. You can also go to virtual photo galleries and buy photos for your real estate. Whatever your take is on the new virtual world – it exists in its infancy, and the next generation of consumers will be/are already lapping this up.

I believe that if you want to make a living from your photography, you have to be where your clients are.

Where can you buy/sell NFTs?

Several market places exist where you can sell your work. They are all different, and some are more focused on art, graphic work, trading card, sports memorabilia, or videos.

The main ones I’ve researched and found suitable for photographers are Foundation, Opensea, Rarible, Mintable, SuperRare, and NiftyGateway. Please do your research into all of them, as there are different networks and access criteria for all of them. Foundation, for example, is by invite only, so have to get networking to gain access to that one.

Wallets to buy and NFT collection

Digital wallets will be a requirement to access all of them, just like you may access many random websites with your Google or Facebook login. These wallets are much like the banking app on your phone. You may need more than one here because there are different networks, much like you may bank with many banks and so have multiple apps.

You get custodial walls and non-custodial wallets that you can sign up to. Research both because custodial is controlled and the coins owned by the exchange, and others like Metamask, which I used, are non-custodial, which means I own the coins inside. Your banking account is custodial in that it is not your money that you see as your balances but rather the bank’s IOU to you when you arrive to withdraw some cash (you are an unsecured creditor to them). Cash in your hand belongs to you. Cash in the bank belongs to the bank. Coins in custodial wallets belong to the exchange (until you need to trade them), coins in your non-custodial wallet belong to you. I know this is a long-winded explanation, but it’s a vital fundamental of the decentralisation in the crypto world you need to understand. Pick which side you are happy to risk being on. If the banks crash, your money is gone. If the exchanges crash, or are hacked, your crypto is gone.

Steps to selling or buying NFTs

There are terabytes of information out there, with both articles and videos about this topic, so I didn’t want to go into too deep a session about the technicalities. The goal was to explain why I am in this market place whether it is a fad or a future trend.

Step one – Get a good understanding of Blockchain and crypto. I know that that seems an impossible task when you look at it, but there are some great videos on YouTube out there. Understand the basics there, and don’t worry about all the different coins and tokens. Bitcoin (BTC) and Ethereum (ETH) are the only Blue-chip cryptos you need to start with. The other seventeen thousand coins are just noise that will make sense once you have a good understanding. Start by subscribing to the Coin Bureau on Youtube. Guy is the presenter, and his team generate fantastic videos (the best out there IMO). They have already created hundreds of videos. Once you have subscribed to his video channel – search his channel with the term “101” – this will bring you all sorts of videos about starting out in this market.

Step two – Once you have a good understanding of blockchains and have even bought some crypto on an exchange, look at the NFT sites I mentioned before. Research each one by using their name and the terms “pros/cons” as a search term in Google. This will lead you down another rabbit hole. The goal here is to pick one site to create your first NFT. Note which wallet they need you to get to operate (e.g., Opensea require a Metamask or a Coinbase one, plus some other specific wallets), and what crypto is within that wallet. Also, analyse what fees are charged for minting your NFT if you’re going to sell. This may make a difference to the number of photos you may want to mint in the end.

In conclusion

Blockchains and crypto are here to say. The sheer adoption not just by individuals but now by companies, large banks and investment firms hint at its permanence. The SEC (Securities and Exchange Commission), despite being anti-crypto, has approved crypto ETFs and will authorise more. They would not be doing this if the intention was to ban crypto. They may push for more regulation and taxation, but that is expected when technologies become mainstream.

You can sit there and wait, or you can get to grips with the tech and get in early. Even at a high level, it’s your decision to make. Don’t forget there are very few who understand how the IP/TCP/HTTP protocols support or run our current internet. You carry on using it regardless. A time will come when the same applies to blockchain. In the meantime, I will continue to sell NFTs as I continue to sell prints in traditional legacy areas

Fight the fear, get educated and have fun. If you need to chat, email me

To get more photographic articles, see my latest photos, benefit from print giveaways and free gifts, please subscribe to the monthly newsletter